Introduction:

The allure of digital payment platforms like Cash App lies in their convenience and speed, allowing seamless transactions with just a few taps on a smartphone. However, what happens when you encounter the puzzling scenario of someone sending you money on Cash App, but you can’t seem to find it in your account? This article delves into the intricacies of such a situation, offering insights, troubleshooting steps, and practical tips to navigate the complexities of the digital payment realm.

1. Understanding the Dynamics of Cash App Transactions:

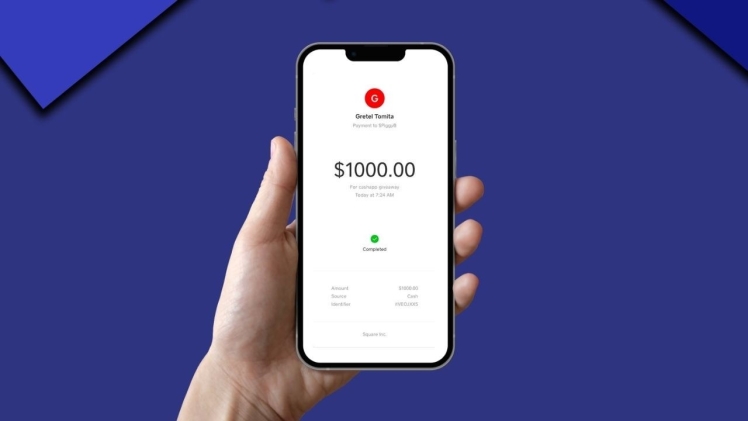

Before delving into the possible reasons for not seeing the sent money, it’s crucial to understand how Cash App transactions work. When someone sends you money on Cash App, the transaction should be almost instantaneous, appearing in your Cash App balance immediately. However, glitches, technical issues, or user error can disrupt this seamless process, leading to delays or complications.

2. Confirm the Transaction Details:

The first step in addressing the issue is to confirm the transaction details. Open your Cash App and navigate to the Activity tab, where you can view a record of all your transactions. Locate the specific transaction where someone sent you money and ensure that the details, including the amount and the sender’s information, match the intended transfer.

3. Check Your Cash App Balance:

Ensure that your Cash App balance accurately reflects the received amount. Your balance is essentially the sum of all incoming and outgoing transactions. If the balance doesn’t align with the expected amount, there might be a delay or a problem with the transaction.

4. Confirm the Sender’s Details:

Mistakes can happen, and it’s possible that the sender entered incorrect information. Verify with the sender that they used the correct email address or phone number associated with your Cash App account. A small typo in the contact information can lead to the funds being sent to the wrong account.

5. Examine Your Linked Bank Account or Card:

If your Cash App balance doesn’t reflect the expected funds, check the linked bank account or debit card associated with your Cash App account. Sometimes, the funds might be directed to your linked external account instead of remaining within your Cash App balance.

6. Check for Cash App Updates:

Like any other mobile application, Cash App regularly receives updates to enhance functionality and address potential bugs. Ensure that you have the latest version of the Cash App installed on your device. Outdated versions might not process transactions correctly, leading to discrepancies in your account balance.

7. Contact Cash App Support:

If the issue persists and you’ve ruled out user error or technical glitches on your end, it’s time to reach out to Cash App support. Open the app, go to the profile icon in the upper-left corner, scroll down to “Cash Support,” and describe the issue you’re facing. Cash App’s customer support team can investigate the matter and provide guidance on resolving the discrepancy.

8. Understand Cash App Security Protocols:

Cash App, like other financial platforms, prioritizes user security. In some cases, transactions might be flagged for review, leading to a temporary hold on the funds. This can occur if Cash App’s security algorithms detect suspicious activity or if the transaction triggers certain parameters. Contacting Cash App support is the best way to address security-related concerns.

9. Verify Your Identity:

Cash App may, at times, request additional verification of your identity to ensure the security of your account. If you haven’t completed the identity verification process, it could lead to delays in processing transactions. Check if Cash App has any pending identity verification requests and complete them promptly.

10. Be Wary of Scams:

In the digital payment landscape, scams are unfortunately prevalent. If you receive unexpected funds from an unknown or unverified source, exercise caution. Scammers might attempt to exploit vulnerabilities, and accepting funds from suspicious transactions could lead to complications. If you’re uncertain about the legitimacy of a transaction, contact Cash App support for guidance.

Conclusion:

The realm of digital payments, while incredibly convenient, is not immune to glitches, delays, or user-related errors. If you find yourself in the perplexing situation of someone sending you money on Cash App, but you don’t see it, patience and a methodical approach are key. Confirm transaction details, check your balance, examine linked accounts, and stay informed about the latest updates from Cash App.

In most cases, discrepancies can be resolved through careful examination and communication with Cash App support. Remember, the digital payment landscape is continually evolving, and proactive engagement with the platform, coupled with a keen awareness of security measures, will empower you to navigate the complexities of Cash App transactions successfully.